Child Tax Credit

The child tax credit is going back to its pre-2021 form. That means the 2022 credit amount drops back down to $2,000 per child. Children who are 17 years old don’t qualify for the credit this year, because the former age limit (16 years old) returns. For some lower-income taxpayers, the 2022 credit is only partially refundable (up to $1,500 per qualifying child), and they must have earned income of at least $2,500 to take advantage of the credit. And there will be no monthly advance payments of the credit in 2022. https://www.irs.gov/pub/taxpros/fs-2022-28.pdf

Child and Dependent Care Tax Credit

For 2022, the child and dependent care credit is non-refundable. The maximum credit percentage drops from 50% to 35%. For 2022, the credit is only allowed for up to $3,000 in expenses for one child/dependent and $6,000 for more than one. When the 35% maximum credit percentage is applied, that puts the top credit for the 2022 tax year at $1,050 (35% of $3,000) if you have just one child/dependent in your family and $2,100 (35% of $6,000) if you have more. In addition, the full child and dependent care credit will only be allowed for families making less than $15,000 a year in 2022.

Earned Income Tax Credit

The minimum age for a childless worker to claim the EITC jumps back up to 25 for 2022. The maximum age limit (65 years of old) is also back for 2022. The maximum credit available for childless workers also drops from $1,502 to $560 for the 2022 tax year. In addition, the rule allowing you to use your 2019 earned income to calculate your EITC if it boosted your credit amount no longer applies.

There several inflation-based adjustments that modify the EITC for 2022. The maximum credit amount is increased from $3,618 to $3,733 for workers with one child, from $5,980 to $6,164 for workers with two children, and from $6,728 to $6,935 for workers with three or more children. The earned income required to claim the maximum EITC is also adjusted annually for inflation. For 2022, it’s $10,980 if you have one child ($10,640 for 2021), $15,410 if you have two or more children ($14,950 for 2021), and $7,320 if you have no children ($7,100 for 2021).

The EITC phase-out ranges are adjusted each year to account for inflation. For 2022, the credit starts to phase out for joint filers with children if the greater of their adjusted gross income (AGI) or earned income exceeds $26,260 ($25,470 for 2021). It’s completely phased out for those taxpayers if their AGI or earned income is at least $49,622 if they have one child ($48,108 for 2021), $55,529 if they have two children ($53,865 for 2021), or $59,187 if they have three or more children ($57,414 for 2021). For other taxpayers with children, the 2022 phase-out ranges are $20,130 to $43,492 for people with one child ($19,520 to $42,158 for 2021), $20,130 to $49,399 for people with two children ($19,520 to $47,915 for 2021), and $20,130 to $53,057 for people with more than two children ($19,520 to $51,464 for 2021). If you don’t have children, the 2022 phase-out range is $15,290 to $22,610 for joint filers ($14,820 to $21,920 for 2021) and $9,160 to $16,480 for other people ($8,880 to $15,980 for 2021).

Finally, the limit on a worker’s investment income is increased to $10,300. https://www.irs.gov/newsroom/changes-to-the-earned-income-tax-credit-for-the-2022-filing-season

Recovery Rebate Credit

There are no stimulus check payments in 2022, so there will be no Recovery Rebate Credit for 2022.

Premium Tax Credit

American Rescue Plan Act (ARPA), which was signed into law in March 2021, enhanced the credit for 2021 and 2022 to lower premiums for people who buy coverage on their own. Under the ARPA, you were considered to have met the premium tax credit’s household income requirements for the 2021 tax year if you (or your spouse if you filed a joint return) received, or were approved to receive, unemployment compensation for any week in 2021. However, if you receive unemployment benefits in 2022, you must satisfy all the normal eligibility requirements. The Inflation Reduction Act extended most of the premium tax credit enhancements through 2025. Unfortunately, though, the relaxed eligibility requirements for people who received unemployment compensation in 2021 was not extended to 2022 or beyond.

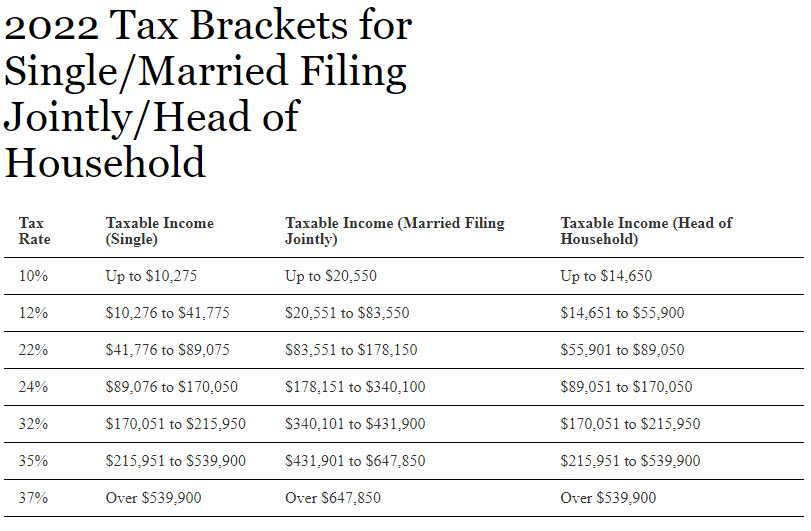

Tax Brackets

Although the tax rates didn’t change, the income tax brackets for 2022 are slightly wider than for 2021. https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

Long-Term Capital Gains Tax Rates

In 2022, the 0% rate applies for individual taxpayers with taxable income up to $41,675 on single returns ($40,400 for 2021), $55,800 for head-of-household filers ($54,100 for 2021) and $83,350 for joint returns ($80,800 for 2021).

The 20% rate for 2022 starts at $459,751 for singles ($445,851 for 2021), $488,501 for heads of household ($473,751 for 2021) and $517,201 for couples filing jointly ($501,601 for 2021).

The 15% rate is for filers with taxable incomes between the 0% and 20% break points.

The 3.8% surtax on net investment income stays the same for 2022.

Standard Deduction

Married couples get $25,900, plus $1,400 for each spouse age 65 or older. Singles can claim a $12,950 standard deduction. Head-of-household filers get $19,400 for their standard deduction, plus an additional $1,750 once they reach age 65. Blind people can tack on an extra $1,400 to their standard deduction ($1,350 for 2021). For 2022, as in 2021, 2020, 2019 and 2018, there is no limitation on itemized deductions, as that limitation was eliminated by the Tax Cuts and Jobs Act. https://www.irs.gov/newsroom/year-round-tax-planning-all-taxpayers-should-understand-eligibility-for-credits-and-deductions also see: https://www.irs.gov/taxtopics/tc502

1099-K Forms

**DELAYED UNTIL 2023 TAX SEASON**

Third-party payment settlement networks (e.g., PayPal and Venmo) will send you a Form 1099-K if you are paid over $600 during the year for goods or services, regardless of the number of transactions. https://www.irs.gov/businesses/understanding-your-form-1099-k

Charitable Gift Deductions

Deductions for up to $300 of charitable cash contributions ($600 for married couple filing a joint return) expired at the end of 2021. The 2020 and 2021 suspension of the 60%-of-AGI limit on deductions for cash donations by people who itemize also expired.

Retirement Savings

For people who are still saving for retirement, many dollar limits on retirement plans and IRAs are higher in 2022. The maximum contribution limits for 401(k), 403(b) and 457 jumps from $19,500 to $20,500 for 2022, while people born before 1973 can once again put in $6,500 more as a catch-up contribution. The 2022 cap on contributions to simple IRAs is $14,000 , plus an extra $3,000 for people age 50 and up.

The 2022 contribution limit for traditional IRAs and Roth IRAs stays at $6,000, plus $1,000 as an additional catch-up contribution for individuals age 50 and up. Contributions phase out in 2022 at AGI’s of $204,000 to $214,000 for couples and $129,000 to $144,000 for singles.

Deduction phaseouts for traditional IRAs also start at higher levels in 2022, from AGIs of $109,000 to $129,000 for couples and $68,000 to $78,000 for single filers. If only one spouse is covered by a plan, the phaseout zone for deducting a contribution for the uncovered spouse starts at $204,000 of AGI and ends at $214,000.

More lower-income people may be able to claim the “saver’s credit” in 2022, too. This tax break can be worth up to $1,000 ($2,000 for joint filers), but you must contribute to a retirement account and your adjusted gross income (AGI) must be below a certain threshold to qualify. The income thresholds are $34,000 of adjusted gross income (AGI) for single filers and married people filing a separate return, $68,000 for married couples filing jointly, and $51,000 for head-of-household filers. https://www.irs.gov/newsroom/irs-announces-changes-to-retirement-plans-for-2022

Adoption of a Child

For 2022, the adoption credit can be taken on up to $14,890 of qualified expenses. The full credit is available for a special-needs adoption, even if it costs less. The exclusion for company-paid adoption aid was also increased from $14,440 to $14,890. https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

Student Loan Interest Deduction

If you’re filing anything other than a joint return, the phase-out range did not change for the 2022 tax year. The credit amount still starts dropping if your modified AGI is over $70,000 and is reduced to zero once your modified AGI hits $85,000. However, for married couples filing a joint return, the phase-out range is adjusted for 2022. It kicks in at $145,000 ($140,000 for 2021), while the credit is fully phased out if modified AGI exceeds $175,000 ($170,000 for 2021).

Teacher Expenses

Teachers and other educators who use their own money to buy books, supplies, COVID-19 protective items, and other materials used in the classroom can deduct up to $300 of these out-of-pocket expenses. The maximum deduction for 2022 jumps to $600 for a married couple filing a joint return if both spouses are eligible educators. Homeschooling parents can’t take the deduction. https://www.irs.gov/newsroom/new-school-year-reminder-to-educators-maximum-educator-expense-deduction-rises-to-300-in-2022

Kiddie Tax

The first $1,150 of a child’s unearned income is tax-free if the child is 18 years old or younger, or a full-time student under 24. The next $1,150 is taxed at the child’s rate. Any excess over $2,300 is taxed at the parent’s rate. https://www.irs.gov/taxtopics/tc553

Residential Clean Energy Credit

The credit is increased to 30%. It eventually drops to 26% for 2033 and 22% for 2034, before the credit expires in 2035. In addition, it doesn’t apply to biomass furnaces and water heaters anymore.

Clean Vehicle Credit

This requirement is effective for vehicles sold after August 16, 2022. Therefore, if you purchase an electric vehicle between August 17 and the end of the year, you won’t qualify for the existing credit for the purchase of a new electric vehicle if it wasn’t assembled in North America.

To help determine if a vehicle satisfies this new requirement, the U.S. Department of Energy has a general list of vehicles with final assembly in North America on its website.

Under the new law, in order for an electric vehicle to qualify for the credit, a certain percentage of the critical minerals in the vehicle’s battery must be (1) extracted or processed in the U.S. or a country that has a free trade agreement with the U.S., or (2) recycled in North America. In addition, a certain percentage of the vehicle’s battery components must be manufactured or assembled in North America. These requirements don’t take effect until the Treasury Department issues proposed guidance about them. The guidance must be issued by December 31, 2022.

If you purchased a new electric vehicle before August 16, 2022, but you don’t actually take possession of the vehicle until August 16 or later, you can still claim the credit based on the old rules in place before August 16. https://www.irs.gov/credits-deductions/individuals/plug-in-electric-drive-vehicle-credit-section-30d

Bonds Used for Education

The exclusion starts phasing out above $128,650 of modified AGI for couples and $85,800 for others . It ends at modified AGI of $158,650 and $100,800. The savings bonds must be used to help pay for tuition and fees for college, graduate school or vocational school for the taxpayer, spouse or a dependent.

Parking and Transportation Benefits

The 2022 cap on employer-provided tax-free parking goes up from $270 to $280 per month. The 2022 exclusion for mass transit passes and commuter vans is also $280. https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

Americans Working Abroad

U.S. taxpayers working abroad have a larger foreign earned income exclusion in 2022. It jumped from $108,700 for 2021 to $112,000 for 2022. The standard ceiling on the foreign housing exclusion is also increased from $15,218 to $15,680 for 2022. https://www.irs.gov/individuals/international-taxpayers/foreign-earned-income-exclusion

Payroll Taxes

The Social Security annual wage base is $147,000 for 2022. The Social Security tax rate on employers and employees stays at 6.2%. Both workers and employers continue to pay the 1.45% Medicare tax on all compensation in 2022, with no cap. Workers also pay the 0.9% Medicare surtax on 2022 wages and self-employment income over $200,000 for singles and $250,000 for couples. The surtax doesn’t effect employers. The nanny tax threshold went up to $2,400 for 2022. https://www.irs.gov/taxtopics/tc751

Standard Mileage Rates

From January 1 to June 30, the 2022 standard mileage rate for business driving is 58.5¢ per mile. The mileage allowance for medical travel and military moves for the same time span is 18¢ per mile.

From July 1 to December 31, the 2022 mileage rate for use of an automobile for business purposes rises to 62.5¢ per mile. The standard rate for medical-related driving and military moving expenses jumps to 22¢ per mile for the second half of 2022.

The standard mileage rate for the use of an automobile for charitable purposes didn’t change, it stayed at 14¢ a mile due to being fixed by law. https://www.irs.gov/newsroom/irs-increases-mileage-rate-for-remainder-of-2022

Per Diem Rate Changes Starting October 1, 2022

The annual update includes the per diem rate under the high-low substantiation method for travel within the continental United States, which for non-high-cost localities will be $204. The rate for travel to high-cost localities within the US, which are listed in the notice, is $297. Those current rates for the period Oct. 1, 2021, to Sept. 30, 2022 are, respectively, $202 and $296. The portion of the rates treated as paid for meals is $74 for high-cost US localities and $64 for all other US localities, which has not changed.

The notice also revises the list of high-cost localities for the upcoming new annual period (Oct. 1, 2022, to Sept. 30, 2023) for which the new rates are in effect. High-cost localities have a federal per-diem rate of $250 or more.

Notice 2022-44 also provides the special rates for taxpayers in the transportation industry. The meals and incidental expenses rates are $69 for any locality of travel within the US and $74 for localities of travel outside the US, both the same with no changes.

The incidental-expenses only rate remains $5 per day as currently, for travel both in and outside the continental United States. https://www.irs.gov/pub/irs-drop/n-22-44.pdf

Long-Term Care Insurance Premiums

Taxpayers who are age 61 to 70 can deduct up to $4,510 for 2022. The 2022 deduction limits for all age groups are the same as the 2021 amounts.

- 40 years old or less = $450

- 41 to 50 years old = $850

- 51 to 60 years old = $1,690

- 61 to 70 years old = $4,510

- 71 years of age or older = $5,640

For most taxpayers, long-term care premiums are medical expenses deductible only by itemizers on Schedule A.

Health Savings Accounts (HSAs)

The annual cap on deductible contributions to health savings accounts (HSAs) rose in 2022 from $3,600 to $3,650 for self-only coverage and from $7,200 to $7,300 for family coverage. People born before 1968 can put in $1,000 more.

Qualifying insurance policies must limit out-of-pocket costs in 2022 to $14,100 for family health plans and $7,050 for people with individual coverage. Minimum policy deductibles remain at $2,800 for families and $1,400 for individuals. https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

Flexible Spending Accounts (FSAs)

The limit on employee contributions to a healthcare flexible spending account is $2,850. If the employer’s plan allows the carryover of unused amounts, the maximum carryover amount for 2022 is $570. The normal limit of $5,000-per-year on tax-free contributions applies once again. https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

Alternative Minimum Tax (AMT)

Increased from $114,600 to $118,100 for couples and from $73,600 to $75,900 for single filers and heads of household. The phaseout zones for the exemptions start at higher income levels are $1,079,800 for couples and $539,900 for singles and household heads. https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

Self-Employed Taxpayers

Self-employed people (along with owners of LLCs, S corporations and other pass-through entities) can deduct 20% of their qualified business income, subject to limitations for individuals with taxable incomes in excess of $340,100 for joint filers and $170,050 for others.

Tax credits that were allowed for self-employed people who couldn’t work for a reason that would have entitled them to pandemic-related sick or family leave if they were an employee have expired and aren’t available for the 2022 tax year. https://www.irs.gov/newsroom/for-national-small-business-week-plan-now-to-take-advantage-of-tax-benefits-for-2022-enhanced-deduction-for-business-meals-home-office-deduction-and-more

Estate & Gift Taxes

The lifetime estate and gift tax exemption for 2022 jumped from $11.7 million to $12.06 million — $24.12 million for couples after the death of the first-to-die spouse. In addition, the deadline for electing portability is pushed back from two years to five years for smaller estates that aren’t required to file Form 706 because their assets don’t exceed the exemption amount.

For the estate of a person dying this year, up to $1.23 million of farm or business real estate can receive discount valuation, letting the estate value the realty at its current use instead of fair market value.

If one or more closely held businesses make up greater than 35% of a 2022 estate, as much as $656,000 of tax can be deferred and the IRS will charge only 2% interest.

The annual gift tax exclusion for 2022 rises from $15,000 to $16,000 per donee. So, you can give up to $16,000 ($32,000 if your spouse agrees) in 2022 without having to file a gift tax return. https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

Tax season alerts and planning ahead for 2023

Taxpayers face a number of issues due to critical tax law changes that took place in 2021 and ongoing challenges related to the pandemic. The IRS continues to share updated information for people now filing their 2021 tax returns and those planning for the 2022 return they will file next year, as well as anyone who has previous year tax returns awaiting processing by the IRS.

This special alerts page is designed to help anyone whether they are now preparing their tax return or are awaiting processing of a return or refund and the latest updates on IRS letters, or notices. Newer updates will be placed at the top of that page; the IRS will also provide critical updates through social media.

Plan ahead with these steps:

https://www.irs.gov/individuals/steps-to-take-now-to-get-a-jump-on-next-years-taxes